Europe caught in the crossfire — U.S. and China’s tech war sparks fears of a new resource crisis

Published on October 22, 2025 by Ruta R Deshpande

Rising Tech Tensions Between West and East

Technology competition between the US and China has intensified over recent years, covering sectors such as artificial intelligence, drones, robotics, and missile development. Europe, however, is caught in the middle, facing growing risks due to its dependence on both American digital services and China’s rare earth supply chains. Experts warn that European industries could face delays, shortages, and rising costs in critical technologies. This vulnerability places Europe at a strategic disadvantage amid ongoing global tech rivalries.

Historical Context of Export Controls

Since 1949, the United States and its allies have used export controls to limit access to key technologies for rival nations. During the Cold War, these restrictions targeted the Soviet Union, preventing sales of advanced computers, microchips, and oil extraction equipment. The policies created a significant technological gap, contributing to the eventual collapse of the Soviet Union. Today, the same strategy is applied against China, with controls on microchips and machinery, aiming to slow its technological advancement in crucial industries.

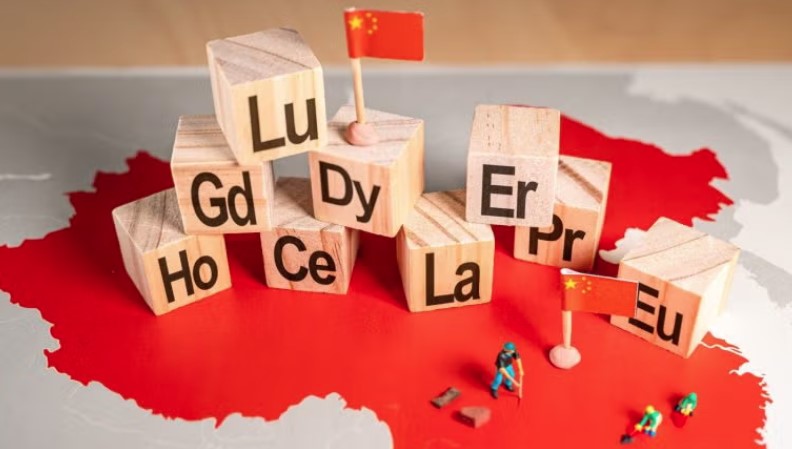

China’s Rare Earth Leverage

China has gained significant influence in global technology through its control of rare earth metals. Recently, Beijing restricted exports of 12 out of 17 rare earth elements, essential for electronics, defense equipment, and renewable energy technologies. These metals, including dysprosium and terbium, are critical for drones, tanks, submarines, and missiles. By controlling their supply, China can directly impact manufacturing worldwide, creating strategic pressure on nations reliant on these minerals, especially Europe, which lacks a self-sufficient rare earth industry.

Green Energy and Strategic Minerals

Critical minerals are vital not only for defense but also for renewable energy technologies such as solar panels, wind turbines, and electric vehicle batteries. Europe historically led the world in renewable energy innovation, but its dependence on Chinese-processed minerals now undermines this position. While the US works to rebuild its own rare earth industry and secure access to lithium and other minerals, Europe faces political and environmental obstacles in exploiting domestic resources. This dual reliance leaves European industries exposed to external pressures and market fluctuations.

Rare Earths in Modern Conflicts

Modern military conflicts demonstrate the importance of rare earth elements. In one week-long exchange of missiles in the Middle East, approximately 800 missiles were launched, each containing between two and twenty kilograms of rare earth metals. These metals, used in electronics, magnets, and precision guidance systems, were vaporized in just seven days. This example highlights the critical role of these minerals in defense operations and the potential vulnerabilities of nations, such as European states, that rely on imports for production of weapons and technology.

Ukraine’s Drone Operations and Chinese Imports

Ukraine’s recent success in drone operations depends heavily on imported electronics and magnets, nearly all sourced from China. The country faces a constant challenge in maintaining the flow of these critical components. European arms shipments are less of a concern compared with the supply of Chinese technology. Without access to China’s rare earth elements and processed minerals, Ukraine’s drone effectiveness could diminish. This example underscores how heavily modern warfare relies on rare earths and illustrates Europe’s broader exposure to supply chain risks.

China’s Global Mineral Dominance

China has become the world leader in processing almost all of the 54 minerals classified as critical by the US Geological Survey. Its industry can process these materials roughly 30% more cheaply than competitors, giving it a strong advantage in global markets. This dominance makes it difficult for Europe to compete without significant subsidies or investment. As China controls essential inputs for electronics, defense, and renewable energy, Europe’s reliance on imports increases, limiting the continent’s ability to act independently in strategic technology sectors.

US-China Tech War Intensifies

The US and China continue to impose measures against each other in technology industries. Washington restricts China’s access to powerful microprocessors, while China limits rare earth exports. Both countries aim to dominate AI, robotics, quantum computing, drones, and missile technology. Whoever gains leadership in these sectors will hold significant economic and military power for decades. Meanwhile, Europe is caught in the middle, heavily reliant on both nations. Its industries face risks from delays, rising costs, and limited control over critical materials.

Europe’s Vulnerability in the Conflict

Europe remains ill-prepared to compete in the global race for critical minerals and high-tech industries. Investments in advanced technology are far smaller than those of China or the US. Environmental opposition and political barriers prevent Europe from exploiting domestic mineral resources effectively. Dependence on both Chinese rare earth processing and American digital infrastructure leaves European industries exposed to external pressures. This vulnerability threatens the continent’s ability to maintain a leading position in defense, renewable energy, and other high-tech sectors critical for the 21st century.

DeftechTimes is your go-to news portal for the latest updates on geopolitics, defense, and technology. Stay informed with in-depth analysis, breaking news, and expert insights on global security issues, military advancements, and cutting-edge technological developments shaping the world.

Editor Picks

Latest News

© All Rights Reserved with Deftech Times