Saudi Arabia has opened the oil spigots, dramatically increasing oil production in a move that has shaken global energy markets. Officially, the kingdom presents this as routine oil-market management, but analysts say the real strategy is far more complex. Saudi Arabia is trying to regain market share lost to countries like Brazil, Guyana, and U.S. shale producers. At the same time, it aims to control OPEC members who often exceed their production quotas and generate revenue for large infrastructure projects that are currently facing cost overruns and delays.

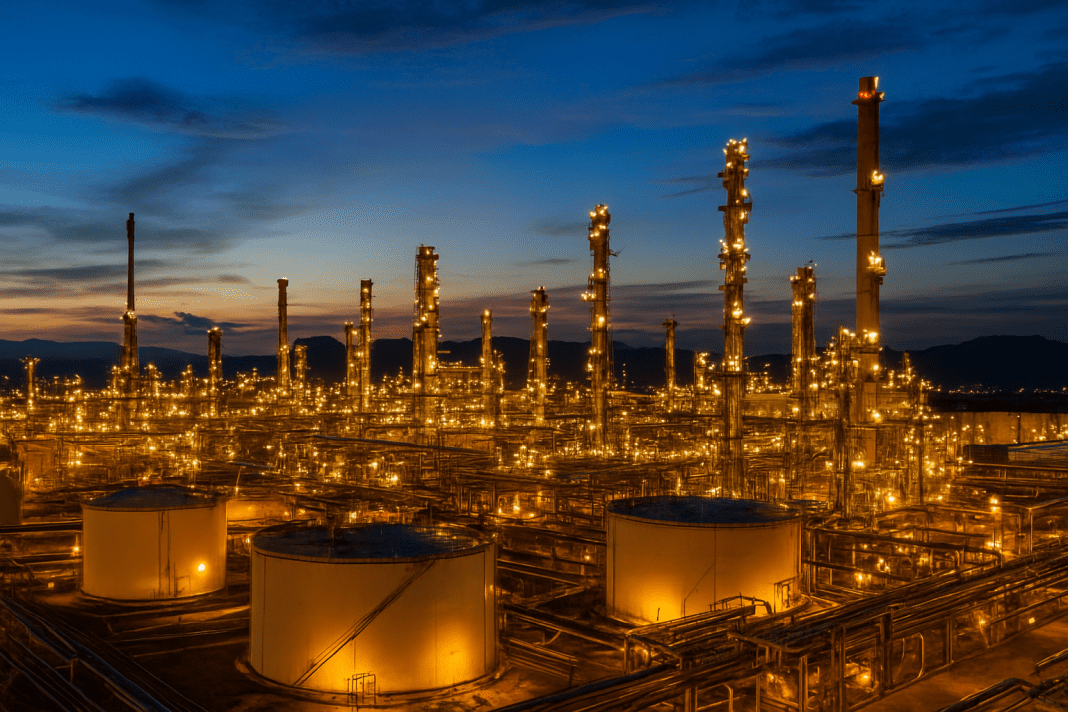

Saudi Arabia’s Bold Oil Production Strategy

This strategic increase in oil production has indirectly benefited the Trump administration. By adding more crude oil to the global market, gas prices in the United States have fallen, providing immediate relief for American consumers. President Trump has repeatedly emphasized the need for lower fuel costs, and more Saudi oil on the market helps achieve that goal.

Average gas prices were recently reported at $3.16 per gallon, slightly down from last year, according to AAA. Lower oil prices also ease inflationary pressures caused by Trump’s tariffs, giving the U.S. economy a boost as households and businesses exercise caution in spending.

Saudi Arabia issues fierce warning as West Bank annexation threatens ties with Israel

White House spokeswoman Taylor Rogers said, “President Trump is providing producers with the resources they need to unleash innovation, reduce break-even costs, and lead in global energy markets to provide affordable and reliable energy.” This statement reflects the administration’s perspective that the Saudi strategy aligns with U.S. energy priorities.

Trump and Saudi Ties Strengthen

The close ties between the Trump family and Saudi Arabia are longstanding. Crown Prince Mohammed bin Salman was the first foreign leader Trump met during his second term. Saudi Arabia has pledged $600 billion in investments in the United States this year alone, covering defense, artificial intelligence, and energy sectors.

The Trump Organization has also partnered with Saudi developers on real estate projects, including Trump-branded towers. Most recently, the Saudi sovereign-wealth fund collaborated with Jared Kushner, Trump’s son-in-law, in a $55 billion deal to acquire the video game company Electronic Arts. These ties have created overlapping financial and political interests, positioning the Trump administration to benefit from Saudi Arabia’s oil production policies.

Saudi Arabia’s current strategy represents a contrast to the approach under President Joe Biden. During the surge in oil prices following Russia’s full-scale invasion of Ukraine in 2022, the Biden administration struggled to manage inflation as oil costs spiked. Despite efforts, the Saudis refused to increase oil production to counter the price rise, highlighting the kingdom’s power over global oil markets.

Risks and Rewards of Saudi Oil Production

Saudi Arabia’s increase in oil production carries significant risks, despite the potential benefits. Pumping more oil can depress prices, which may hurt U.S. shale producers and create fiscal challenges for the kingdom. Saudi Arabia can produce crude at less than $10 a barrel, far cheaper than U.S. shale producers. However, the International Monetary Fund estimates that Saudi Arabia needs oil prices at $92 per barrel just to balance its budget. Current Brent crude prices hover around $65 per barrel, far below this break-even level.

Nevertheless, boosting oil production allows Saudi Arabia to strengthen its relationships with key customers, particularly in Asia, while regaining some of the market share lost to competitors. Analysts say Saudi Arabia has measured the increase in output to avoid destabilizing the market or angering U.S. producers.

Ellen Wald, senior fellow at the Atlantic Council’s Global Energy Center, noted, “Saudi production increases have been very incremental: They’re not dumping five million barrels a day on the market and putting the U.S. oil industry out of business.”

Hezbollah seeks to restore relations with Saudi Arabia amid escalating strikes in Lebanon

Saudi Arabia still depends heavily on oil, with 53% of its revenue coming from the sector in the first half of this year. Total revenue fell 15% through June, mainly due to a 29% drop in oil income. To fund spending, Riyadh sold assets and issued $65 billion in bonds, raising public debt to nearly 32% of GDP by year-end, up from 5.8% a decade ago.

The kingdom continues to influence OPEC, which controls about 40% of global oil output. OPEC+ is expected to approve another oil production increase, lowering prices to a four-month low. Analysts say prices fall either through U.S. production or Saudi-led OPEC output, and with U.S. shale focused on efficiency, Saudi Arabia’s oil production remains the main driver of the market.