CK Hutchison Holdings, one of Hong Kong’s largest business groups, has been managing ports at both ends of the Panama Canal since 1997. These ports, Balboa and Cristobal, are crucial because the canal is one of the world’s busiest shipping routes.

Hutchison Navigates Major Global Ports Deal in Panama

In March 2025, CK Hutchison announced that it would sell all its shares in two of its port companies—Hutchison Port Holdings and Hutchison Port Group Holdings.

The buyer was supposed to be a consortium made up of major global investors. This group included Global Infrastructure Partners, a firm under the U.S. investment company BlackRock, and Terminal Investment Limited, a company linked to the Mediterranean Shipping Company. The deal was huge—worth nearly $23 billion. This included $5 billion in debt that the buyers would also take on.

This agreement meant that the group would gain control of 43 ports in 23 countries. That’s a major share of the global shipping infrastructure, including the two vital ports at the Panama Canal. Because of the size and importance of the deal, approval was required from several governments, including Panama.

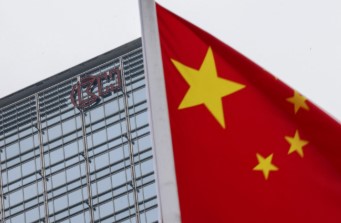

Geopolitical Tensions Between China and the U.S.

Although the involvement of U.S.-based BlackRock pleased the American side, the reaction from China was very different. Beijing was reportedly unhappy with CK Hutchison’s decision to sell its port assets to a group that did not include Chinese investors. One Beijing-backed newspaper described the move as a “betrayal of all Chinese.” This kind of strong language indicated how seriously Chinese authorities took the issue.

Chinese government offices in charge of Hong Kong affairs reposted the newspapers that criticized the deal. In China, people widely see this as a sign that the central leadership agrees with the criticism. As a result, Chinese anti-monopoly regulators began reviewing the deal.

Flagged and Dumped! Panama Boots 650 Ships Linked to Sanctions, Smuggling & Shady Deals

This situation put CK Hutchison in a difficult position. On one side, it was trying to make a business decision that satisfied U.S. partners and governments. On the other side, it had to be careful not to upset Beijing, especially since the company is based in Hong Kong—a city whose leadership must now follow strict loyalty rules set by China. The family of Hong Kong’s richest man, Li Ka-shing, controls the company, which adds to the political and business pressure.

Hutchison Explores New Deal Structure with China

After months of uncertainty and tension, CK Hutchison announced that the exclusive negotiation period with the original consortium had ended on July 27. That means the company is no longer bound to only talk to this group of buyers.

In a recent statement, Hutchison said that it is still in discussions with the consortium. However, they now want to change the structure of the deal. Most importantly, Hutchison said it is considering adding a major strategic investor from the People’s Republic of China to the buying group.

This change could potentially make the deal more acceptable to Chinese regulators and ease political tensions. But it also raises questions about how the United States will respond, since it had previously welcomed the fact that Chinese investors were not part of the original deal.

US Investment Firms Trapped as China Regulator Blocks Billion-Dollar Panama Canal Sale

Hutchison explained that changes to both the membership of the consortium and the structure of the transaction are necessary for the deal to get approval from all relevant authorities. That includes governments and regulators in Panama, China, and possibly the United States.

Earlier in May, one of Hutchison’s co-managing directors had informed shareholders that Terminal Investment Limited was the main investor in the deal. This company is controlled by the Aponte family of Italy, who are known to have long business ties with the Li family.

As things stand, CK Hutchison is navigating a very complex situation. It has to balance business interests, political concerns, and regulatory approvals from multiple countries. The final outcome of this major global port deal remains under close watch.